JustUs Skincare

Unleashing the Multi-Billion-Dollar Potential of Mature Women in Beauty.

The Team

Brook Dougherty

Co-Founder + Chief Alchemist

Evelyn Sprigg

Co-Founder + CEO

Lindsey Boan

Head of Paid Media

Karee Maxson

Head of Content

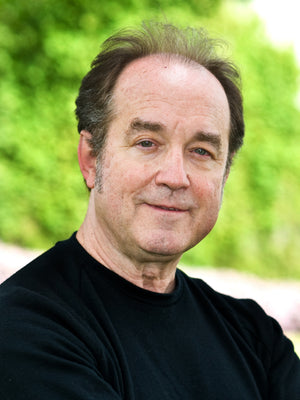

Robert Dowdell

Founding Chemist, The Body Shop

Jay Dougherty

Chief Legal

Invest in Us

How do you unlock multi-billion dollar potential? This particular door takes several different keys.

We have identified and tapped into the trigger spot for a high value target, and we know how to reach them efficiently.

When you have that combination, it’s a matter of time to scale.

Mature women feel invisible in beauty

The beauty industry has ignored one of its most powerful customer segments: mature women. With half of all women over 20 falling into the 55+ category, we’re talking about a massive, untapped market. This is a multi-billion-dollar opportunity, and we are leading the charge.

Botanicals offer powerful benefits

Our ancient botanicals are sourced globally from regions like the Brazilian Rainforest and Africa.

Specifically designed for mature skin

JustUs is built from the ground up to address issues relating to SWAG (sagging, wrinkles, age spots and glow).

Our products work

We have countless stories of women sharing how their skin saw instant and long-term change. It's why they reorder over and over and over again.

Whats in your jar?

This is a comparison of a top-shelf luxury formulation. Which would you rather use?

we have the formula

Our experienced team has used a test & learn approach to do the hard work of achieving efficient and effective paid and organic advertising that results in loyalty and smart areas of expansion.

our method is proven

We understand what our woman is seeking. A chance to try (they have been let down too many tmes in the past) and a product offering that allows for repeat and new purchases on a regular basis.

Defined Growth Plan

Our business is ready to scale. We have laid the foundation so the capital infusion can focus on accelerating the growth we are already experiencing. As an e-commerce-first model we have created an efficient process and maintained healthy margins.

Addressing a massive and underserved customer

In the U.S., there are 21 million women aged 65+ who fall within the top 50% of income earners, representing a $9.45 billion total addressable market (TAM).

Among them, 8.4 million actively purchase anti-aging skincare, forming our serviceable available market (SAM) of $3.78 billion.

We are targeting 1.5% of this segment, which equates to 126,000 loyal customers and a serviceable obtainable market (SOM) of $56.7 million in annual revenue.

Our A-Team

We have experience across formulation, marketing, IP, content and beyond.

Our ask

We hope you will join us as an angel investor in our goal to reach $250k. We are in the prime position to scale, together.

Thank you!

You know how to find us! evelyn@justusskincare.com, brook@justusskincare.com

Faqs

The Investment Opportunity

What is the opportunity?

We are offering a SAFE agreement. The “Discount Rate” is 90% and the “Post-Money Valuation Cap” is $5,000,000.

What is a SAFE agreement?

SAFE (Simple Agreement for Future Equity)

First developed by Y Combinator in 2013, a SAFE grants an investor the right to obtain equity at a future date if the startup sells shares in future financing. It has historically been used by top Silicon Valley startups, raising money from accredited angel investors. You should only invest in a SAFE if you believe the startup can raise financing in the future from professional investors.

Early-stage startups use SAFEs because they delay the difficult task of figuring out how much a startup is worth. It is also a much cheaper and simpler contract than priced equity rounds, which may require months of negotiation and upwards of 30 pages of legalese, costing tens of thousands of dollars.

The number of shares you receive is determined at the next priced financing when professional investors – typically venture capitalists – set the price for preferred stock. Then, calculated using the Valuation Cap and sometimes the Discount Rate, your SAFE often converts into shares at a lower price than the venture capitalists paid since you invested earlier.

The Valuation Cap is the most important term in this security. It puts a maximum price on the stock price - the lower the price, the more shares you will get. If you invest in a startup with a valuation cap of $8 million, and they later raise at a $20 million Pre-Money Valuation, the amount of stock you'll get will be priced off the $8 million number. But, if the next investors value the company at $4 million, that will be your price instead (perhaps further discounted by the Discount Rate ).

Unlike a Convertible Note, a SAFE is not a loan. As such, it does not accrue interest, have a maturity date, or have a legal obligation to be paid back. This makes it a simpler and cheaper way to finance a startup, and it typically better aligns with the intention of most early-stage equity investors who never intended to be lenders (convertible notes are rarely, if ever, paid back in cash despite being a debt instrument – the startup goes bankrupt).

What is Post-Money Valuation?

The post-money valuation is the valuation of the company after the investment has been made. It is equal to the pre-money valuation plus the amount of the investment. For instance, a venture capitalist might determine a company has a pre-money valuation of $15 million. The VC then invests $5 million in exchange for a fourth of the company. The post-money valuation is $20 million.

What is a valuation cap?

The Valuation Cap is the most important term of a convertible note or a SAFE. It entitles investors to equity priced at the lower of the valuation cap or the pre-money valuation in the subsequent financing. Typical Valuation Caps for early stage startups currently range from $2 million to $20 million.The valuation cap is a way to reward seed stage investors for taking on additional risk. The valuation cap sets the maximum price that your convertible security will convert into equity. To translate that into a share price, you divide the valuation cap by the series A valuation. Let's say you invest in a startup using a note with a $3 million cap. If the series A investors decide that the company is worth $6 million dollars and pay $1/share, your note will convert into equity AS IF the price had actually been $3 million. By dividing $3 million by $6 million we get an effective price $.50/share. That means that you will get twice as many shares as the series A investors for the same price

The Risks

What are potential risks?

The Company may never receive a future equity financing or elect to convert the Securities upon such future financing. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an IPO. If neither the conversion of the Securities nor a liquidity event occurs, the Purchasers could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Our future success depends on the efforts of a small management team. The loss of services of the members of the management team may have an adverse effect on the company. There can be no assurance that we will be successful in attracting and retaining other personnel we require to successfully grow our business.

The skincare market is highly competitive and the needs of the consumer can change over time.

Cash flow management is crucial for growing companies. If JustUs is unable to secure additional funding or manage cash flow effectively, it could impact expansion and operational continuity.

Other Questions

What is an angel investor?

Someone who invests small amounts of money in startups. The term's origin is from the 1920's, to describe a new investor in a new Broadway play.

What is an accredited investor?

Someone with a net worth over $1M (minus their home) or who made $200K+ for the past 2 years and expects the same this year. $300K if joint with a spouse.

OR

Someone who holds a Series 7, 65, or 82. You can test into these licenses!